Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 1.2% for the week.

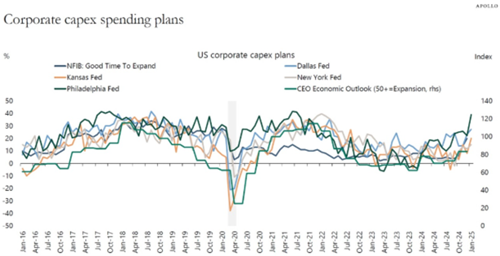

- Multiple business surveys are reflecting an acceleration in corporate investment. If those plans come to fruition, it could be a tailwind for corporate profits.

In recent weeks, the Trump administration has been floating, implementing, and delaying a wide range of tariffs on imported goods from several countries. The list of tariffs is too long to inventory here, but much digital ink has been spilled about the varying effects such trade policies are expected to have upon consumer prices and employment.

There have been a few drips of anecdotal evidence suggesting that the on-again-off-again approach taken with tariffs thus far will create policy uncertainty, which will, in turn, freeze business investment. “Investment” in this context does not mean investment in stocks and bonds. Rather, it refers to the creation of wealth or “capital.” Building factories, machines, and creating software are a few examples of investment, also referred to as capital expenditure or “capex”.

Regardless of its definition, investment is an important source of corporate profits. For a company that makes a capital expenditure on a machine, they exchange one asset (cash) for another asset (the machine). The investment in the machine does not change the net worth of the company. However, the suppliers that built and sold the machine receive revenue from the sale. That represents profits.

In numerous recent surveys, businesses have stated their intentions to ramp up capital investment. Surveys are “soft data”. They do not necessarily mean that the plans will come to fruition. However, there is an unmistakable rise in business planning for investment, per the chart below:

Source: Torsten Slok, Chief Economist, Apollo, February 2025

The theory that tariff talk is creating uncertainty for businesses does not appear to hold water. Perhaps the expectations of tariffs have led to the recent rise in domestic investment planning. Or, businesses might simply be discounting the tariff talk as bluster, and it is other expected policy changes (regulatory, tax, etc.) that have improved business investment sentiment. Either way, a material pickup in capital expenditure would be a welcome tailwind for corporate profits.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication.

Copyright Indiana Trust Wealth Management 2025.