Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 1.7% for the week.

- Could 2025 be the year when cheap equity valuations in Europe begin to look like a bargain?

Europe’s stock markets have badly trailed the US market in recent years. Some of this performance disparity has been attributed to a lack of fast-growing companies in Europe, particularly in the technology sector.

Some of the growthiest firms in the US are also the largest names by market capitalization. The “Magnificent Seven” names, which include NVIDIA and Microsoft, have had mammoth returns. In the process, they have become increasingly expensive on a price-to-earnings (P/E) basis and have propelled the US stock market’s overall valuation to new heights versus stocks in Europe.

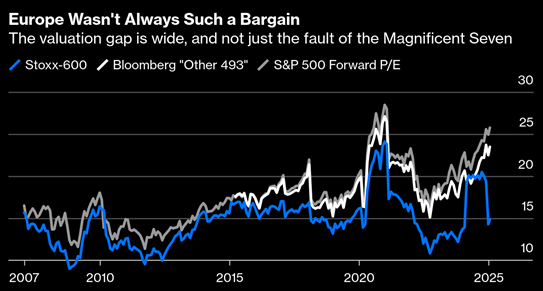

Interestingly, excluding the Magnificent Seven names, the US market is still quite expensive on a P/E basis relative to Europe. In the chart below, Europe’s P/E (the blue line) ended 2024 at a record 40% discount versus the S&P 500 (the grey line) and the “Other 493” US stocks (the white line representing the S&P 500 minus the Magnificent Seven).

Source: Bloomberg, January 2025

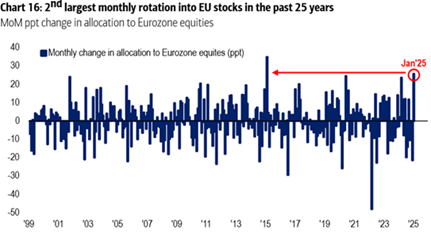

So, stocks in Europe are cheap versus the US market no matter how it is sliced. This is nothing new. However, something in Europe – perhaps the most recent yawning of the valuation gap – has attracted investor attention in 2025. The Bank of America survey of Global Fund Managers in January reflected the second largest shift by respondents to Eurozone equities in the last 25 years.

Source: Bank of America Global Fund Survey, January 2025

So far, those managers have been rewarded. The broad FTSE Eurofirst 300 index reached an all-time high this week, and the STOXX 50 index of European blue chips is up 7% this year.

Perhaps the valuation disparity between the US and Europe could become less justified in the coming years. One near-term relative tailwind for Europe is that markets expect the European Central Bank to cut interest rates by 1% this year, whereas the Fed is expected to cut only 0.25%. And, while the US economy is growing faster than Europe, the growth gap between the two is closing. The US is no longer growing at twice the rate of Europe.

As John Authers at Bloomberg wrote this week, while events are unpredictable in the region, it wouldn’t take much good news in Europe (for example, in Ukraine) for its relatively low equity market valuations to look like a bargain.

European stocks may well be cheap for a reason, but they sure are cheap.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication.

Copyright Indiana Trust Wealth Management 2025.