Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, slipped 0.7% for the week.

- Long-term bond yields are rising, an unusual development considering the Fed has cut its overnight target interest rate by 1% since last September.

On September 18th last year, the Federal Open Market Committee – the part of the Fed that makes interest rate decisions – gathered and decided to lower its overnight target interest rate by 0.50%. The move was the Fed’s first interest rate cut since it began hiking rates in 2022 to tackle inflation. At its next two meetings in November and December, the Fed cut by 0.25% each, lowering its target interest rates by 1% in total.

The 10-year US Treasury was falling last September, reaching 3.6% two days before the Fed’s outsized 0.50% cut. The yield on the 10-year US Treasury note is viewed as the bellwether interest rate for all types of medium- and long-term lending, from car loans to 30-year mortgages.

Then, something unusual occurred. The 10-year yield began to rise. This week, the 10-year made it all the way back to 4.7% (almost touching 4.8% on Friday).

To summarize: since September, the Fed has cut its overnight target rate by 1% while the 10-year Treasury has risen by more than 1%. In bond market parlance, the yield curve has steepened: long-term rates are above short-term rates.

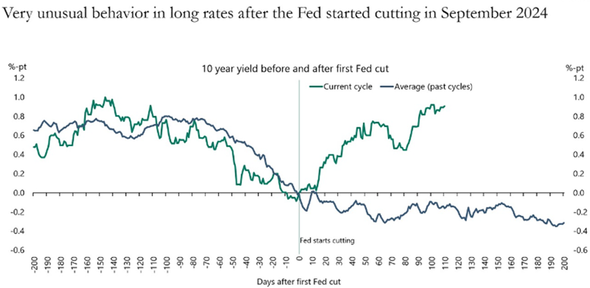

It is more typical for long-term rates to fall when the Fed is easing. A chart from Apollo Chief Economist Torsten Slok illustrates the divergence between the 10-year Treasury yield’s behavior during the current rate cutting cycle (green line) versus its average yield during past Fed cutting cycles (blue line):

Source: Bloomberg, Apollo, January 2025

What makes this time different? In the past, it has been the norm for the Fed to wait until an economic slowdown or recession has been underway before it begins to lower interest rates. That is why long-term rates have typically fallen after the Fed starts to cut: the Fed has been cutting in already-deteriorating economies, and the bond market has expected more cuts in the future.

In this cycle, the Fed began cutting prior to a slowdown. The labor market has cooled, but the jobs report for December, released on Friday, was good. The Atlanta Fed’s GDPNow tracker currently pegs economic growth for the fourth quarter at 2.7%. The economy has not stalled yet.

Perhaps the bond market was overly pessimistic about economic growth and employment back in September, factoring in too many future interest rate cuts by the Fed. A recalibration appears to have occurred.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication.

Copyright Indiana Trust Wealth Management 2025.