Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 0.7% for the week.

- The dollar has slipped versus most major currencies this year, a trend which could provide a tailwind for foreign equity market returns.

Due to the end of massive debt-fueled overinvestment in real estate, China’s economy has dramatically slowed. As most developed countries’ central banks, including the Federal Reserve, have been raising interest rates to fight inflation in recent years, China has been facing the opposite problem: deflation.

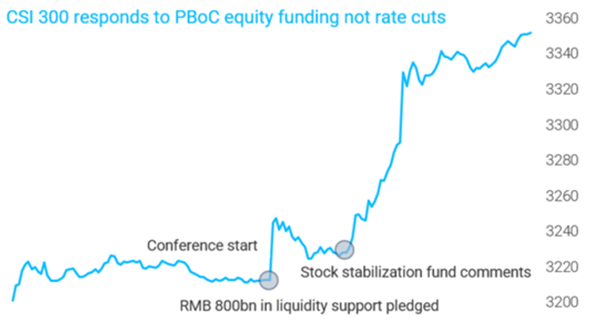

Earlier this summer, the People’s Bank of China (the “PBOC”, China’s central bank) cut a key interest rate to support its flagging economy. This week, the PBOC unleashed a so-called “credit bazooka”, cutting three key interest rates and announcing the establishment of a government-supported stock market stabilization fund.

The rate cuts were mostly ignored by investors, but the stock stabilization fund comments (translation: Chinese government will buy stocks) finally ignited the CSI 300, the Shanghai stock market index. That index rose by over 15% this week, its best weekly performance in 16 years.

David Tepper, widely viewed as one of the most successful hedge fund managers of all time, took to the airwaves, declaring that he was buying “everything China, ETFs, futures, everything.” As an aside, Mr. Tepper also owns the Carolina Panthers NFL team, who drafted Alabama quarterback Bryce Young at #1 overall in 2023, widely viewed as becoming one of the biggest draft busts in NFL history.

Source: TS Lombard, September 2024

Theoretically, the PBOC’s monetary policy moves should have weakened the Chinese currency, the yuan, relative to the dollar. Instead, the opposite is occurring. The yuan recently hit a 15-month high.

The yuan isn’t the only currency strengthening versus the dollar. The euro also hit a 14-month high on Wednesday, and the pound sterling is at its highest in two and a half years. Currency markets are re-evaluating the speed at which the Fed will cut interest rates this year, given the Fed’s decision to kick off its interest rate cutting cycle with an outsized 0.50% reduction two weeks ago. A faster pace of rate cuts than previously anticipated could weaken the dollar.

A stretch of dollar weakness could carry positive implications for allocations to international equities. The total return on foreign stocks includes a component driven by currency fluctuations. In dollar terms, shares of stocks denominated in euros and pounds are worth more if those currencies appreciate relative to the dollar.

For years, a strengthening dollar has been a drag on foreign stock market returns. The recent reversal of this headwind, should it continue, would be a welcome development for international equity returns.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication.

Copyright Indiana Trust Wealth Management 2024.