Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 4% for the week.

- The Fed’s forward guidance has already lowered interest rates that impact the US economy, before any actual interest rate cuts by the Fed have occurred.

The big debate in markets over the last few weeks has been whether the Federal Open Market Committee (the “FOMC”), the part of the Federal Reserve that sets interest rate policy, will reduce its target overnight interest rate by 0.25% or by 0.50% at its September 18 meeting. Futures markets show that there is a dead heat between the two potential moves. The current effective overnight interest rate stands at 5.3%.

Due to ongoing disinflation and a stalling jobs market, the voices calling for a 0.50% cut have grown louder.

While it may create some excitement in markets next week, whether the Fed cuts by 0.25% or 0.50% this Wednesday may not make much of a difference for the economy and markets in the coming months and years. Either the Fed is already too late with its rate cuts, or it is not. A 0.50% cut would send a strong message, but ultimately it would still leave the Fed with an effective overnight interest rate that is viewed as “restrictive”.

Also, whether the FOMC goes with a 0.25% or a 0.50% cut misses the fact that, in a sense, the Fed’s interest rate cuts have already begun. The Fed has become very crafty with its communications – its “forward guidance”. The speeches and interviews by Fed officials can make a big impact on medium- and long-term interest rates, those not directly controlled by the Fed, before the FOMC decides to do anything at all on the overnight target interest rate, which it does control.

Three weeks ago, Fed Chairman Jerome Powell gave a consequential speech in which he left no doubt that the FOMC would be lowering its overnight interest rate at upcoming meetings. Mr. Powell stated that the Fed did not want to see further cooling in the labor market, and as a result the “time has come for policy to adjust”. That means interest rate cuts.

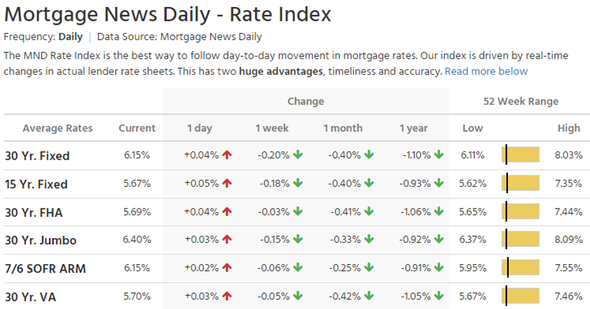

Since late summer, medium- and long-term rates have fallen, and Powell’s speech helped continue that trend. Medium-term rates drive important consumer lending rates, such as those for car loans. Long-term interest rates drive mortgage rates, a critical factor for US housing. The average 30-year fixed mortgage is inching down toward 6%, and virtually every type of mortgage rate is at its lowest level in a year:

Source: Mortgage News Daily, as of September 12, 2024

Long-term interest rates may edge lower next week should the FOMC decide to move 0.50% lower, but the lowering trend is already well underway.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2024.