Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 4% for the week.

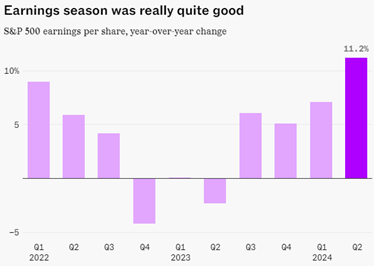

- The second-quarter earnings season is coming to an end, with more than 90% of companies reporting - and it was a very good one for US companies.

A few weeks ago, the US stock market experienced a violent bout of volatility, ultimately selling off over 8% from its July peak. Given inflation is dwindling and the unemployment rate is rising, the Federal Reserve’s reluctance at its last meeting to commit to cutting interest rates led to investor consternation. Stock market volatility spiked, which created pressure on large leveraged bets that volatility would remain low. Margin calls ensued. Those factors, plus healthy doses of “animal spirits” and “who knows?”, seem to explain the downswing.

From that trough, the market has sharply rallied, if not quite all the way back to its July high. Weekly jobless claims have come in on the low side, and inflation data this week was soft, evidence that the economy is cooling rather than falling off a cliff. The unemployment rate’s rise may be due to higher levels of labor force participation, which creates a different economic environment than if mass layoffs were the cause. (That said, although this is a more benign driver for the rise in unemployment, perhaps the Fed should consider the cost of a new labor force entrant unable to find work.)

Investors may be mollified by recent economic data, but there is another more straightforward reason to consider for the market’s rebound: corporate earnings have been very good. “S&P 500 operating earnings per share (EPS) rose y/y in Q2 to a record high,“ Ed Yardeni and Eric Wallerstein of Yardeni Research observed on Monday.

Source: Sherwood News, August 15, 2024

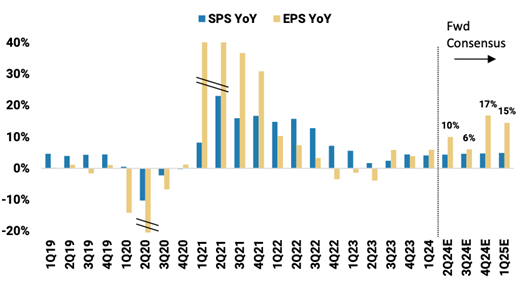

Market valuations, such as the P/E ratio, have risen this year, becoming more expensive. After several quarters of steady sales per share growth (in the chart below, SPS YoY) and slower EPS growth (EPS YoY), consensus estimates (Fwd Consensus) suggest that earnings are in the process of accelerating. If growth materializes as expected, current elevated valuations may be justified.

Sources: Sam Ro, FactSet, Morgan Stanley Research

Incoming economic data points in the coming weeks may drive more volatility, but for now it appears that fundamentals are providing support for share prices.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication.

Copyright Indiana Trust Wealth Management 2024.