Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, was flat for the week.

- The Federal Reserve faces growing risks from its current restrictive monetary policy stance, as evidenced in fewer job openings and plummeting housing construction.

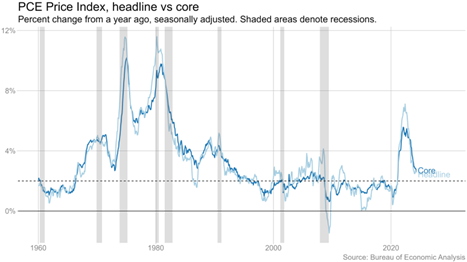

On Friday, the Bureau of Economic Analysis released its Personal Consumption Expenditures (PCE) index figure for May. The PCE, the Federal Reserve’s preferred gauge of inflation, rose by approximately zero percent for the month. “Core” PCE was up 0.08%, which is also approximately zero percent.

Any way the data may be sliced, inflation has come down meaningfully over the last year. While PCE inflation may be above the Fed’s 2% target on a year-over-year basis, it is not out of line with history.

Source: Ben Casselman, BEA, July 28, 2024

The Fed is doing well on its dual mandate of stable prices and full employment, yet it has not budged on its hawkish, tight monetary policy position. In their public appearances, the members of the Fed’s board of governors have continued using language that does not offer much hope for interest rate cuts.

Given changing dynamics in the economy, the Fed faces major risks to maintaining its high, restrictive interest rate policy. Job openings have come down dramatically, and the economy may be at the point where negative feedback loops can occur for employment should layoffs begin.

Another, perverse risk the Fed faces is that higher interest rates may feed into higher inflation in the future due to their impact on restraining real investment – specifically via the depressive impact high interest rates have upon housing construction.

The Wall Street Journal noted this week that private-equity giant KKR just completed its largest-ever purchase of apartment buildings at a cost into the billions. The article posits that “investors are encouraged by the falling number of construction starts for new apartment buildings, portending lower levels of new supply and faster-moving rents by 2026.” [1]

Construction starts have plummeted due to higher financing costs, and faster-moving rents would feed into inflation - the opposite effect the Fed would wish to see from its high interest rate policy, and good evidence that interest rates are a blunt policy tool for dealing with inflation.

Despite recent inflation readings at zero, it appears the Fed remains concerned about the specter of an inflation bounce in 2024 after the warm inflation readings over the first three months of the year. For those worried about inflation’s resurgence, consider these trends: Job creation is slowing. Job openings have fallen. Housing construction permits have cratered. Wage growth has normalized. Productivity has risen. Where would that inflationary impetus come from now?

Our weekly note will return in mid-July. We wish all of our clients and our partners in our communities a happy and safe Fourth of July!

[1] “KKR Makes Its Biggest Foray Into Apartments, Betting on Rising Rents” by Will Parket, The Wall Street Journal, June 25, 2024

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2024.