Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 1.5% for the week.

- A closely-followed survey indicates economic growth expectations have brightened considerably for Europe relative to the US, a hopeful sign that Europe could be exiting its economic and market doldrums.

There have been multiple roadblocks for Europe’s economy in recent years. For various reasons, Europe’s economy has been rather slow to recover from the pandemic, particularly compared to the US. Then, on the heels of the pandemic, Russia invaded Ukraine, and, more recently, a spike in inflation was anticipated due to Red Sea shipping disruptions.

Fortunately, inflation in the eurozone has declined faster than expected as the impact from shipping issues in the Middle East has been milder than feared, per the European Commission this week. The impact of the invasion of Ukraine has dissipated somewhat, although those risks are ongoing.

Given falling inflation, the European Central Bank is widely expected to start cutting interest rates next month. As a result of these loosening dynamics, European economic growth expectations have brightened considerably for the rest of 2024.

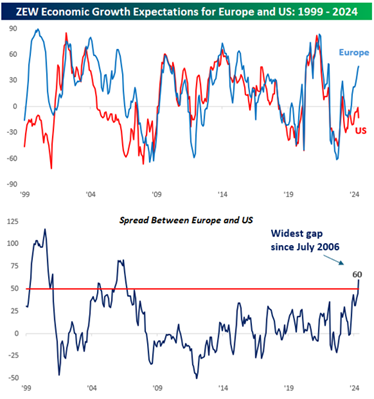

The monthly ZEW Survey – a well-known survey with much history – measures views from experts in banking, insurance, and corporate sectors on the various paths of economic growth, inflation, interest rates, and capital markets. Bespoke Investment Group noted this week that the while the indexes of the ZEW Surveys for Europe and the US generally move in relatively similar directions, there has been a wide disparity in recent months where expectations for European growth have been rapidly improving even as expectations for the US remain subdued.

Bespoke points out that the ZEW Survey’s May release shows the gap in favor of expected European growth has not been as wide since July 2006:

Source: Bespoke Investment Group, 5/14/24

The US stock market has led the way across global equity markets for many years, and Europe has been no exception. European stock markets have a long way to go to make up the lost ground relative to the US since the Great Financial Crisis. That said, there haven’t been many periods of time when the ZEW Survey has tilted so strongly for Europe relative to the US in terms of growth expectations. When it has, European stock markets have outperformed the US.

Could there finally be a light at the end of the tunnel for Europe?

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2024.