Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, was up 0.9% for the week.

- After more soft inflation data was released this week, markets now expect the Federal Reserve to kick off an interest rate cutting cycle in September.

On Thursday, the Bureau of Labor Statistics published its monthly CPI inflation data. UBS economist Paul Donovan summed up the report nicely: harmonized inflation slowed again (to 1.85% year-over-year). Durable goods prices are falling at the most aggressive rate in two decades. Most sectors experienced deflation somewhere in the US.

Mr. Donovan concludes that the Federal Reserve is overdue on interest rate cuts. After this week, markets now widely expect that the Federal Open Market Committee (the “FOMC” is the part of the Fed that makes interest rate decisions) will begin cutting rates at its meeting in September.

As it appears more and more certain that an interest rate cutting cycle is about to begin, it is worth considering how a change to the Fed’s policy rate may impact asset class returns in the coming years. For example, an overall decline in interest rates should be a near-term boost for investment grade bonds, as bond prices move inversely with yields.

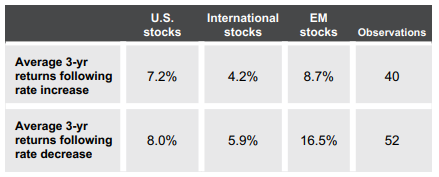

For stocks, the impact is more nuanced. A chart from Russell Investments shows that, going back to 1990, average three-year returns following Fed interest rate decreases have been strongest for Emerging Markets stocks:

Source: Russell Investments, June 30, 2024

High interest rates in the US have contributed to capital outflows from emerging markets in recent years, negatively impacting asset prices in those countries. High rates also raise servicing costs for emerging markets debt, much of which is priced in US dollars. Federal Reserve policy easing could provide emerging markets some relief from those challenges.

Lower policy rates from the Fed could also help small-cap US stocks relative to their large-cap brethren. The most immediate effect is through interest expense: small companies’ liabilities are more exposed to fluctuations in interest rates than the liabilities of large firms, so lower interest rates should help smaller companies’ profits.

On Thursday, the day the CPI data was released, the Russell 2000 index of small cap stocks rose by 3.6% while the NASDAQ index, which is dominated by mega-cap US tech names, fell 1.9%. The 5.5% outperformance by the Russell 2000 over the NASDAQ was the largest daily spread on record.

While one day does not necessarily mean that the market has hit an inflection point, it is an example of how quickly market narratives can change – and why it is important to have thoughtful portfolio asset allocations established prior to those changes to take advantage.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2024.