Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 1.3% for the week.

- Most measures show that the U.S. labor market has normalized. Coupled with inflation drifting lower, the Federal Reserve is on the clock for interest rate cuts in 2024.

Most economists believe that inflation is driven by wage growth, which is driven by demand for labor and “unnaturally” low unemployment. This is why, as the Federal Reserve ratcheted up interest rates in 2022 to halt inflation, Federal Reserve Chairman Jerome Powell on several occasions reminded our citizenry that inflation would not come down without “pain” for households. In Fed-speak, that means putting people out of work. It was believed that unemployment had fallen too far.

Fast forward to 2024, and most measures of tightness in the labor market have normalized. Per the chart below from Harvard economist Jason Furman, five different signals of labor market tightness have normalized to pre-COVID levels:

Source: Jason Furman, June 4, 2024

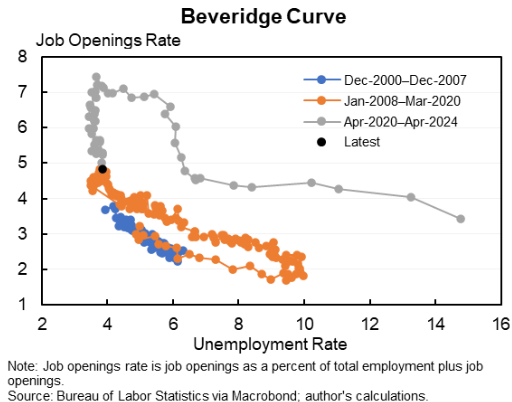

For further evidence of labor market normalization, Mr. Furman also points to a popularly cited (amongst economists) relationship between job openings and unemployment, the Beveridge curve (named for a British economist who never actually drew the curve). The curve has job openings on the vertical axis and the unemployment rate on the horizontal axis. It slopes downward, typically, because a high rate of unemployment corresponds with few job openings:

(Jason Furman, June 4, 2024)

In the first few post-pandemic years, the Beveridge curve (the gray line) looked funky. There were many job openings with high unemployment – which makes some logical sense, given there was a pandemic. Mr. Furman calls this a “temporary dislocation from something like a reallocation shock” in employment.

Job openings have been falling for several months. The latest release of openings data this week from the Bureau of Labor Statistics (the black dot on the chart) represents a “rejoining” of the post-pandemic Beveridge curve with the pre-pandemic curve. The Beveridge curve looks normal again.

“Normalization without pain” was more-or-less the definition of a “soft landing” for the U.S. economy. Employment appears to have normalized, and while inflation has not reached the Fed’s 2% target, it is drifting lower towards that figure.

This week, the Bank of Canada and the European Central Bank both cut their target interest rates as they want to avoid policy “errors” in a normalizing economic environment – that is, unnecessarily keeping interest rates too high and creating economic recessions.

For the same reason, the Fed is now on the clock for rate cuts this summer.

Editor’s note: Our weekly update is on hiatus until June 22.