Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, slipped 0.5% for the week.

- There has been a lot of concern voiced about a few stocks providing the bulk of the US stock market’s return, however low market “breadth” readings have historically led to strong forward returns.

The US stock market’s returns in recent years, 2022 notwithstanding, have been principally driven by the outsized performance of a handful of mega-cap technology names. The so-called “Magnificent Seven” stocks have a few members who have been not-so-magnificent of late, however the point remains that market “breadth” has been poor.

There are many ways to calculate breadth, but generally it is a measure of the number of stocks rising versus the number of stocks falling. Bank of America noted on Friday that, by their gauge, market breadth is currently at its weakest since 2009. That is, many more stocks are falling than rising. Similarly, Bespoke Investment Group’s recent measure of 10-day breadth was in the bottom 10% of readings going all the way back to 2002.

Sherwood News’s Luke Kawa wrote this week that at the headline level, the S&P 500 has made fresh record highs or fallen no more than 1.5% off those levels since May 17, but the share of its constituents trading above their 50-day moving averages has tumbled from 65% to 38%.

This all seems bad. On the surface, the S&P 500 looks fine, but underneath the hood, most stocks are down. Basically, NVIDIA has been holding up the entire market over the last few weeks.

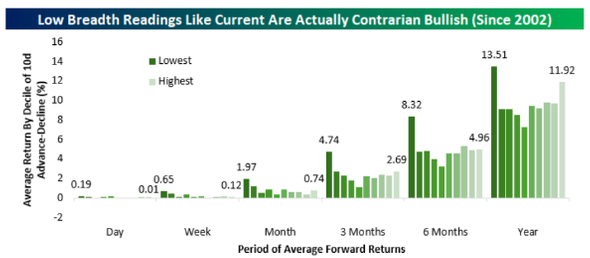

Counterintuitively, Mr. Kawa points out that this type of deterioration of market breadth has historically led to good future overall market performance. He cites a chart from Bespoke, which notes that when breadth is as low as it currently stands – in the bottom decile – it has led to the best market returns (darkest green bars) over the next month, three months, six months, and one year - a striking outcome:

Source: Bespoke Investment Group, May 2024

The reasons why weak market breadth has led to good returns over these short timeframes are hard to pinpoint. Price momentum in a few names may bring traders into the broader market, looking to capitalize upon an upswing trend. It may simply be an anomaly. Regardless, the negative hype surrounding bad market breadth should be viewed with skepticism and, if history is any guide, a pinch of optimism.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2024.