Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 2% for the week.

- The now-higher rate environment will ultimately impact companies with weak balance sheets and smaller firms dependent on external financing, while large investment-grade firms will withstand higher rates.

This week, the Federal Reserve published an analysis of the vulnerability of public companies to persistently higher interest rates or a severe economic downturn.[1] The study incorporates the most recent data of companies’ aggregate debt structure and “maturity wall” to gauge whether firms will be able to service their debt.

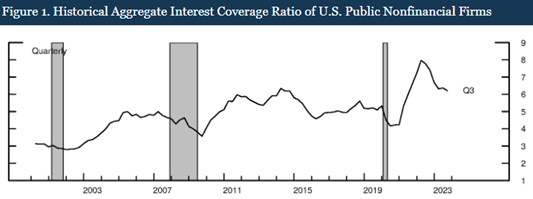

The study takes a close look at the overall interest coverage ratio, which is the ratio of earnings (before interest and taxes) to interest expense. Relative to history, firms’ interest coverage ratios are high – a very good thing, as it is a sign that companies are in a strong overall financial position.

Source: Federal Reserve, FEDS Notes, May 9, 2024

Source: Federal Reserve, FEDS Notes, May 9, 2024

The use of fixed-rate debt and high levels of cash on corporate balance sheets shielded most companies from the Fed’s shift to higher interest rates in 2022, when short- and long-term rates rose steeply. The study concludes that the debt-servicing capacity of the U.S. public corporate sector will remain robust to sustained elevated interest rates.

The study also notes, however, that should interest rates remain high or bump higher from current levels, smaller firms and firms with weaker balance sheets may run into trouble. It appears that the Fed’s attempt at tightening monetary policy by raising interest rates has created a situation of the “haves” (mega-cap corporations with fortress balance sheets, such as Apple and Microsoft) and the “have-nots” (small companies depending on traditional external financing).

The “have-nots” are holding up okay so far, but the likelihood of such adverse outcomes from higher rates has risen. Markets have taken account of the shift in those probabilities. This can be seen most clearly in the underperformance of US small cap equities in recent years. It can also be seen in the daily trading patterns in small caps, which have rallied strongly when US Treasury bond yields have fallen.

Inflation has fallen since 2022, although it remains above the Fed’s target. That, coupled with the low unemployment rate, has given the Fed confidence to hold off on interest rate cuts in 2024. Should inflation continue to show progress and the Fed proceed with interest rate cuts later in the year, the stocks of small companies and firms with fragile balance sheets would likely benefit.

[1] “Stress Testing the Corporate Debt Servicing Capacity: A Scenario Analysis” by Dalida Kadyrzhanova, Ander Perez-Orive, and Eliezer Singer, Federal Reserve, FEDS Notes, May 9, 2024

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2024.